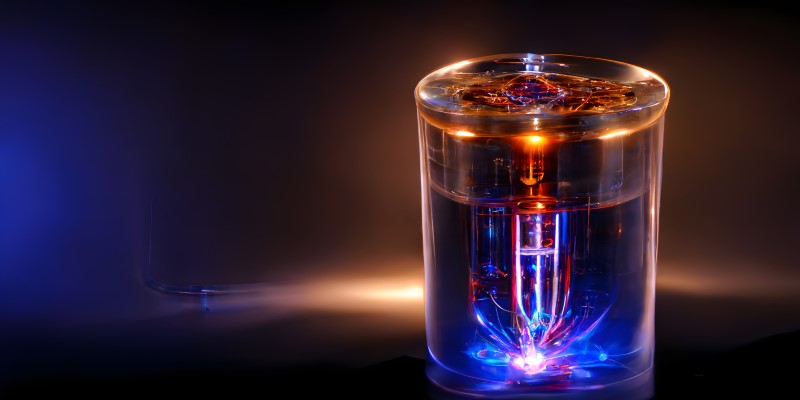

The world is witnessing a revolution in energy storage, with innovations coming thick and fast. Among these groundbreaking technologies is the quantum glass battery, often hailed as the next big thing in energy storage. While traditional lithium-ion batteries have served the market well, their limitations are becoming more apparent as the demand for cleaner, more efficient energy grows.

Quantum glass batteries, with their potential for faster charging, longer lifespan, and higher energy density, are capturing the attention of investors looking for high-growth opportunities in the energy sector. However, before jumping into this promising market, it's crucial to understand what quantum glass batteries are, why they matter, and whether investing in these stocks is truly a wise decision.

What are Quantum Glass Batteries?

Quantum glass batteries, also known as solid-state batteries, are a type of energy storage technology that utilizes a solid electrolyte instead of the liquid or gel-based electrolytes found in traditional lithium-ion batteries. The term "quantum glass" is somewhat of a marketing catchphrase, combining the advanced nature of quantum mechanics with the promise of "glass" electrolytes that are safer and more efficient than conventional materials.

What sets these batteries apart is their ability to hold more charge while being less prone to overheating and degradation. This combination of higher energy density and improved safety makes quantum glass batteries particularly attractive for applications like electric vehicles (EVs), renewable energy storage, and portable electronics.

Why Quantum Glass Batteries Matter in the Energy Landscape

The shift towards electric vehicles and renewable energy sources is accelerating globally, driven by environmental concerns mandates. Traditional lithium-ion batteries, despite their dominance, face challenges such as limited energy density, slow charging times, and safety risks like fires and explosions.

Quantum glass batteries offer a potential solution by significantly improving these shortcomings. Imagine an electric vehicle that charges in minutes rather than hours or a battery that can last hundreds of thousands of miles without degradationthis is the promise that quantum glass batteries hold. For investors, this represents a potentially lucrative opportunity as demand for more advanced energy storage solutions is expected to grow exponentially.

Investing in Quantum Glass Battery Stocks: Market Potential

The market for quantum glass batteries is still in its early stages, but interest is rapidly growing. Major companies and start-ups alike are pouring resources into developing this technology. Firms like QuantumScape, Solid Power, and Toyota are leading the charge, attracting significant investment and partnerships with automakers and tech giants. QuantumScape, in particular, has gained attention with its promises to revolutionize the EV market by delivering batteries that are cheaper, more efficient, and quicker to recharge.

Investing in these companies is not without its risks, however. The technology, while promising, is still in the research and development phase. Scaling up production, ensuring consistent performance, and overcoming manufacturing challenges remain significant hurdles. The timeline for mass commercialization could be years away, which means that these stocks are still speculative. For investors, this translates to high volatility. Prices could soar based on positive announcements or crashes due to setbacks in development.

Evaluating the Long-Term Outlook

The long-term outlook for quantum glass battery stocks hinges on the successful commercialization of the technology. Industry experts currently agree that solid-state batteries, including those branded as quantum glass, could become a dominant force in the energy storage market over the next decade. However, many unknowns remain, including regulatory hurdles, manufacturing challenges, and the potential for alternative technologies to emerge.

For investors with a high-risk tolerance and a long-term investment horizon, quantum glass battery stocks could be a speculative but potentially rewarding addition to a diversified portfolio. Those who prefer less risk should wait until the technology matures and clearer market leaders emerge. In the meantime, keeping an eye on industry developments and the progress of key companies will be crucial.

Key Players in the Quantum Glass Battery Space

Several companies are at the forefront of quantum glass battery development. Understanding who these players are can help you make informed investment decisions.

QuantumScape

QuantumScape, a leader in the development of solid-state batteries, is working closely with Volkswagen to revolutionize the electric vehicle (EV) market. The company's innovative battery technology could potentially extend the driving range of EVs by up to 50% and drastically reduce charging times. However, investors should note that QuantumScape's stock is considered highly speculative, as the scalability of this technology has yet to be proven in real-world applications.

Solid Power

Solid Power has garnered attention and investment from major automotive players like BMW and Ford. The company focuses on advancing solid-state battery technology, which could significantly improve battery energy density and safety. This technology is still under development, but Solid Power's collaboration with industry giants provides a solid foundation for future commercial success.

Toyota

Toyota, a well-established name in the automotive industry, is actively pursuing solid-state battery technology to power its future vehicles. With its extensive resources and longstanding industry presence, Toyota is poised to make significant advancements in this area. The company's commitment to innovation and its plans to launch solid-state battery-powered vehicles soon make it a formidable player in this emerging field.

Conclusion

Quantum glass batteries represent one of the most exciting developments in energy storage, with the potential to transform industries from electric vehicles to renewable energy. For investors, this emerging technology offers an opportunity to get in early on a potentially game-changing innovation. However, the market remains speculative, with significant risks tied to the technology's unproven nature and the challenges of scaling up production.

As with any investment, careful research, a clear understanding of your financial goals, and a balanced approach are key. Whether you choose to dive into quantum glass battery stocks now or wait until the technology matures, the future of energy storage is undoubtedly a space worth watching closely.